Homeowners Insurance in and around Topeka

If walls could talk, Topeka, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

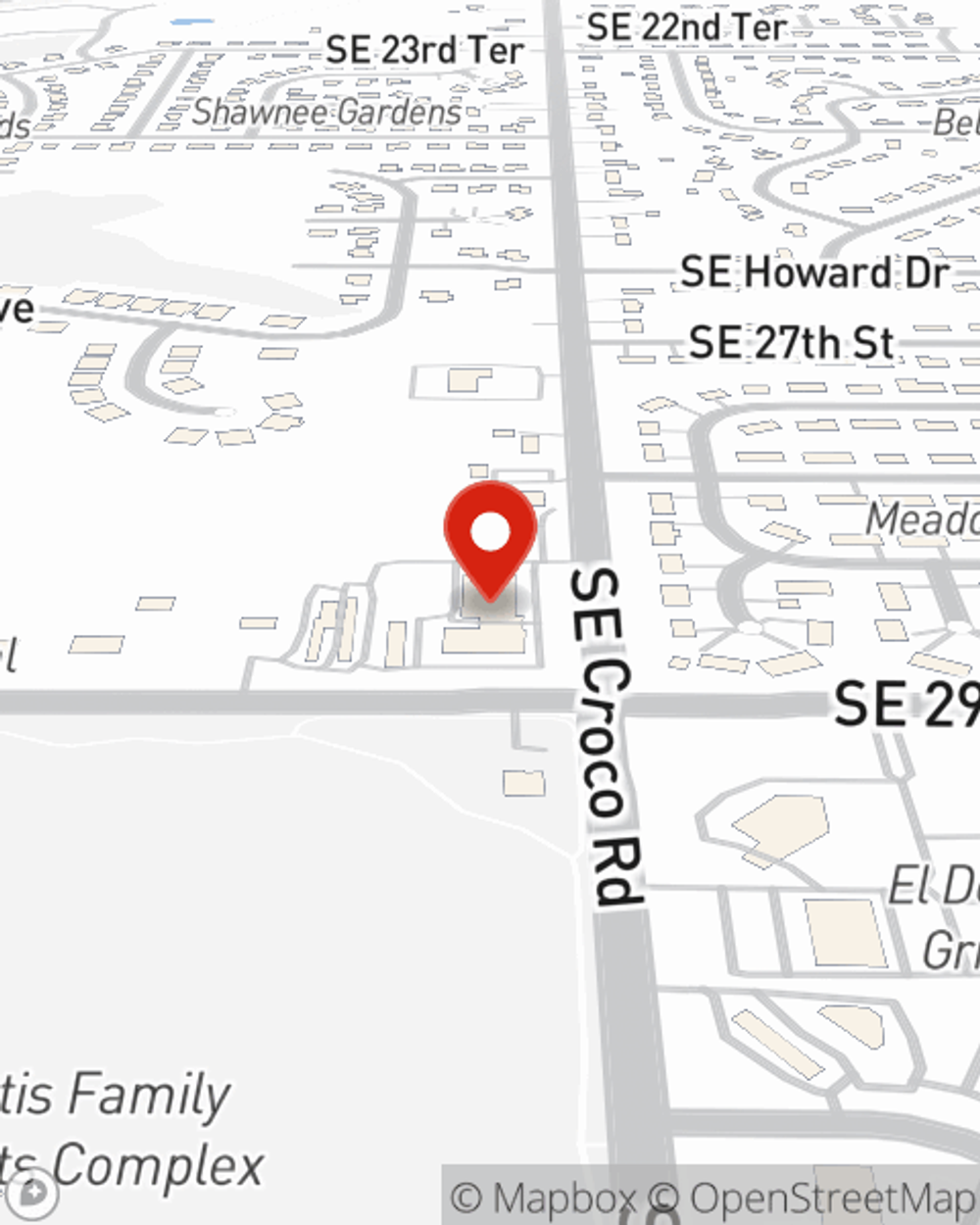

There are plenty of choices for home insurance in Topeka. Sorting through savings options and deductibles isn’t easy. But if you want surprisingly great priced homeowners insurance, choose State Farm. Your friends and neighbors in Topeka enjoy remarkable value and no-nonsense service by working with State Farm Agent Brandon Aldridge. That’s because Brandon Aldridge can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as pictures, jewelry, swing sets, electronics, and more!

If walls could talk, Topeka, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Why Homeowners In Topeka Choose State Farm

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Brandon Aldridge can be there whenever the unexpected happens, to get you back in your routine. State Farm is there for you.

Let us help with the details of protecting your belongings with State Farm's excellent homeowners insurance. All you need to do to get the ball rolling is contact Brandon Aldridge today!

Have More Questions About Homeowners Insurance?

Call Brandon at (785) 267-1428 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Curb appeal ideas to help refresh the exterior of your home

Curb appeal ideas to help refresh the exterior of your home

Here are some curb appeal ideas that might help spruce up the exterior of your home.

Brandon Aldridge

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Curb appeal ideas to help refresh the exterior of your home

Curb appeal ideas to help refresh the exterior of your home

Here are some curb appeal ideas that might help spruce up the exterior of your home.