Business Insurance in and around Topeka

Researching protection for your business? Search no further than State Farm agent Brandon Aldridge!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

The unexpected happens. It's always better to be prepared for the unfortunate accident, like a staff member getting hurt on your business's property.

Researching protection for your business? Search no further than State Farm agent Brandon Aldridge!

Helping insure small businesses since 1935

Insurance Designed For Small Business

With options like worker's compensation for your employees, a surety or fidelity bond, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Brandon Aldridge is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does occur.

Do what's right for your business, your employees, and your customers by contacting State Farm agent Brandon Aldridge today to discover your business insurance options!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

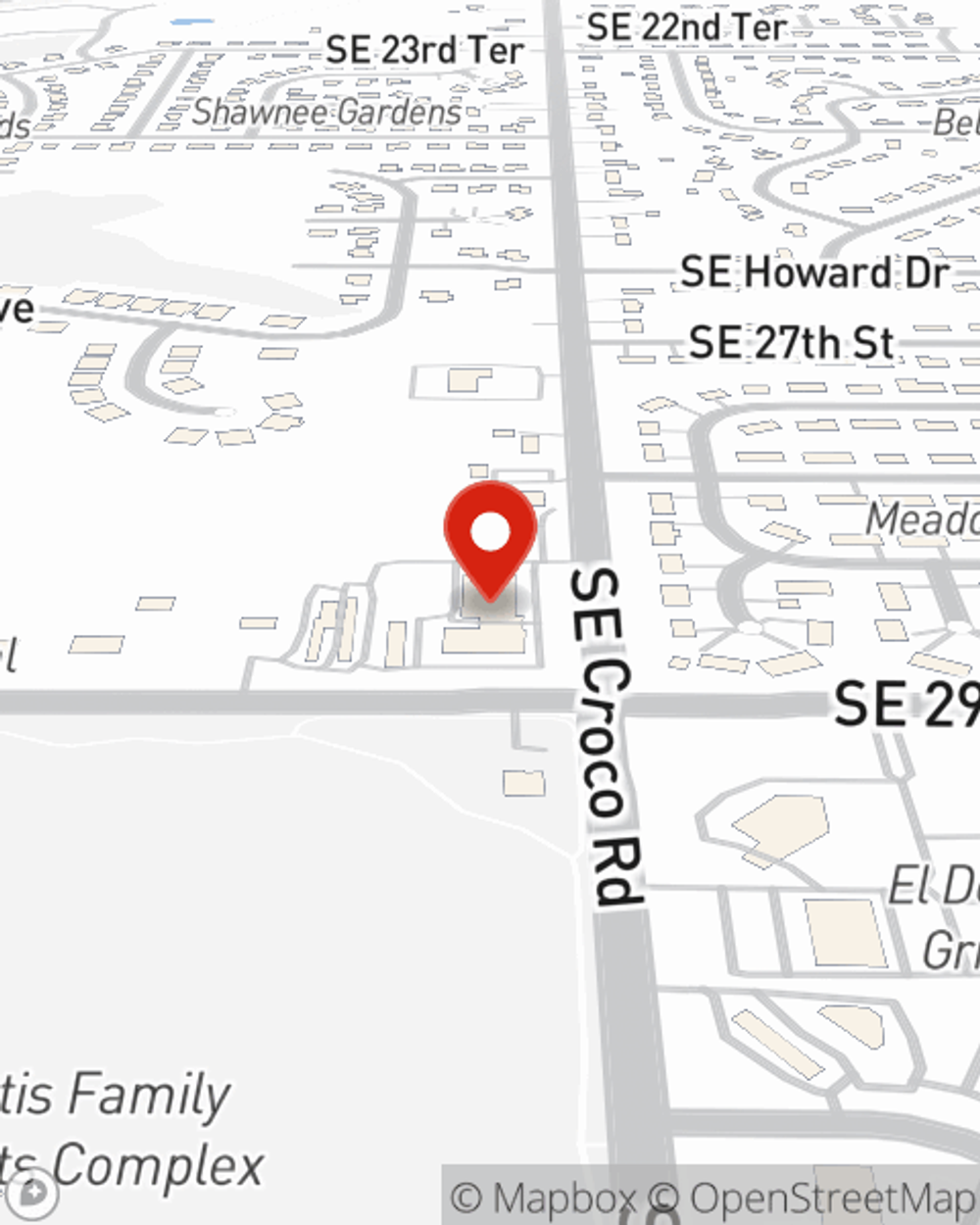

Brandon Aldridge

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.